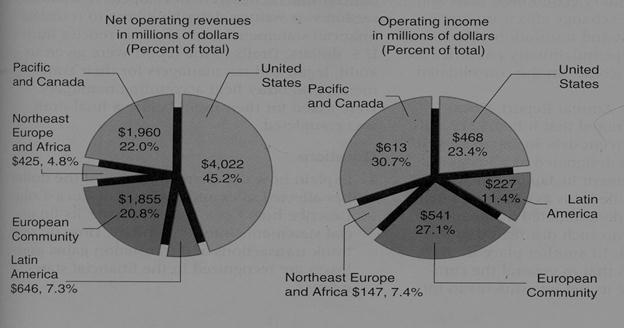

The Coca-Cola Company Geographic Segment Results

Although the United States is clearly the most important geographic area in terms of sales for Coca-Cola, the Pacific and Canada geographic segment provides a greater percentage of operating income than does any other geographic area. Source: 1987 Coca-Cola Annual Report.

As noted earlier, Coca-Cola operates in 155 different countries; it used 40 different functional currencies to translate its financial statements from foreign currencies into U.S. dollars. The dollar is the functional currency of operations in hyperinflationary economies, such as Brazil and Mexico. Exchange effects on foreign currency transactions and translation of balance-sheet accounts in hyperinflationary countries are included in "other income" in the consolidated income statement.

In one place in its Annual Report, Coca-Cola's management noted that it had $212 million worth of 53/t percent debt in Japanese yen, over half of which is designated as a hedge against its net investment in Japan. The 1986 Annual Report classified this as a European debt (Eurocurrency debt denominated in Japanese yen), but there was no such distinction in the 1989 Annual Report. In another place in the same report, it states that in general the company does not hedge its net investments in foreign operations. However, it sometimes enters into hedges to protect cash flows in foreign currencies.