B) Reread the text more carefully to describe the changes in the Yankee offerings and the interests of US investors.

Borrowers Pile Up the Yankees

During the past six years, according to the Federal Reserve, foreign non-financial borrowers placed $170 billion of public and private bonds in the US – nearly four times the volume issued during all of the 1980s and taking the total amount outstanding to $264 billion last September.

Until recently, only the most creditworthy foreign names were able to tap the US bond market, the largest pool of capital in the world. Yankee offerings were mainly limited to Canadian provinces, supranationals such as the World Bank and triple-A-rated governments and corporations. But as long-term US rates have fallen, and some barriers to entry were removed, many more borrowers have entered the market. By some estimates, single-A and lesser credits accounted for 60% of last year's issues (of which 80% were for 10 years or longer).

The introduction of Rule 144a in April 1990 really opened the door, allowing issuers to offer bonds to large US institutional investors without registering the offering with the Securities and Exchange Commission (SEC). This exemption greatly reduces the time, expense and disclosure required, while extending the benefits of underwriting and secondary-market trading to these placements.

The adoption of Rule 144a also helped increase awareness among foreign issuers of the US bond market's unique attractions. "Many can tap 20-, 30- and even 100-year maturities at costs not achievable anywhere else in the world".

On the demand side, US investors are becoming increasingly receptive to foreign names. In a recent survey of the 400 most active US institutional investors, JP Morgan found that foreign bonds now account for between 9% and 10% of the average portfolio, compared with 4% to 5% just three years ago. One reason for this interest is a relative decline in the volume of domestic bond issues, especially by US industrials. In these circumstances investors are looking for new ways to diversify their credit exposure and they have looked overseas.

But the most powerful force behind increased demand has been an attempt by US fund managers to boost returns in hopes of outperforming the benchmark indices.

Why Yankees? Since they don't come to the market often, their yield spreads may not be priced efficiently; it is not uncommon to see a 50 bp difference in spreads between apparently similar issues. Sophisticated managers are looking for "inefficiencies which the market will eventually recognize", resulting in higher bond prices.

Not surprisingly, these investors are focusing on Asia, expect more Yankee issues from Indonesia, India, Thailand and the Middle East.

Words you may need:

pile upv накапливать

creditworthyadj кредитоспособный, платежеспособный

to tap the marketвыпускать ценные бумаги на рынок, использовать ресурсы финансового рынка

triple-A-rated имеющий рейтинг ААА (высший кредитный рейтинг по системе Стэндард Энд Пур)

single-A creditкредит, имеющий рейтинг А (низкий рейтинг)

Rule 144аправило 144а (правило Нью-йоркской фондовой биржи)

disclosuren представление компанией информации о своей деятельности

awarenessn (зд.) осведомленность

receptiveadj восприимчивый

exposure n риск потенциальных убытков

benchmark indexотправной индекс, базовый индекс

spreadn спред

bp (basis points)базовые пункты

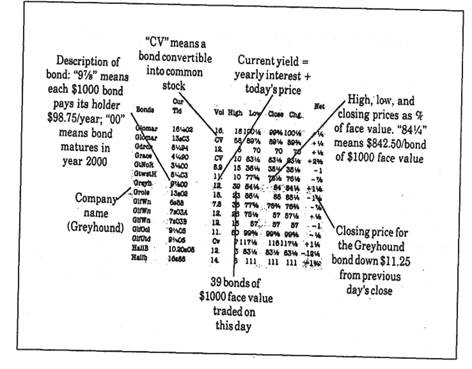

Ex. 19. Study the financial section from a newspaper, which includes information about the bond prices of different companies, and explain how to read bond quotations: