The New Issue Market

The mere buying of securites traded on the Stock Exchange does not create new capital. The stock exchange does not itself issue new shares to the public. Fresh capital is provided through the mechanism known as the New Issue Market.

The Market has no outward formal organization or fixed place of business. Nevertheless it functions efficiently on the basis of a number of institutions working together: issuing houses, joint-stock banks, merchant bankers, insurance companies, stockbrokers, underwriters and others.

Issuing houses have become very active in the New Issue Market recently. An issuing house is a financial firm specializing in the issuing or floating of new securities for governments, municipalities and companies. Although this activity is not directly connected with the Stock Exchange, the Exchange is vitally interested in the activities of issuing houses; and the people who own and operate issuing houses have often been members of stock exchanges. The issuing house undertakes that the whole of a new issue of securities should be sold and makes all necessary arrangements for it.

It is charged with the entire "handling" procedure of the issue: this includes the arrangements for banks, other financial houses to share in the underwriting (only in a few cases do issuing houses underwrite the entire amount themselves); arrangements for the drawing up and publication of the prospectus.

Yet, even the most careful and competent handling will not guarantee the success of an issue. This depends on the attitude of the investing public, who will be guided very much by the reputation of the issuing house itself.

Issuing houses make arrangements with underwriters, who guarantee, for a commission, that if the public does not subscribe fully to the new issue the underwriters take up the remaining shares or stock.

Underwriting is a process whereby a group of investment bankers agree to purchase a new security issue at a set price and then offer it for sale to the general public.

Words you may need:

new issue marketрынок новых эмиссий

mereadj простой

outwardadj внешний

issuing houseэмиссионный дом

underwritern гарант размещения ценных бумаг

floatingn выпуск (акций через биржу)

"handling" procedure(зд.) выполнение всех формальностей

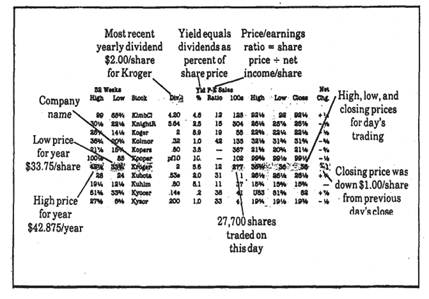

Ex. 19. Study the financial section from a newspaper, which includes information about the stock prices of listed companies, and explain how to read stock quotations: